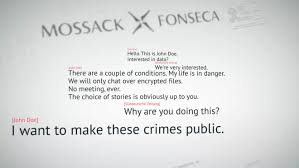

Following the cache of leaked documents from a Panamanian law firm that showed possible wrongdoing using offshore company structures, authorities across the globe have opened investigations into the activities of the world's rich and powerful.

The financial arrangements of high profile politicians and public figures as well as the companies and financial institutions they used for such activities are under the spot light due to the "Panama Papers" leak. The relatives of the leaders of China, Britain, Iceland and Pakistan, and the president of Ukraine and the friends of Russian President Vladimir Putin are among those who have been named in the documents.

There was response of denials from the leading figures and financial institutions to the massive leak of more than 11.5 million documents. As prosecutors and regulators began a review of the reports from the investigation by the U.S.-based International Consortium of Investigative Journalists (ICIJ) and other media organizations, those named in the leaks denied involvement in any wrongdoing.

With the Chinese state media denouncing Western reporting on the leak as biased against non-Western leaders, China has moved to limit local access to coverage of the matter following the reports.

While some countries, including the United States, said they were looking into the matter, other countries like France, Australia, New Zealand, Austria, Sweden and the Netherlands are among nations that have commenced investigations.

More than 240,000 offshore companies were set up for clients by Mossack Fonseca, the Panamanian law firm at the center of the leaks, even as the company has denied any wrongdoing. It claims that media reports misrepresent the nature of its business and calls itself the victim of a campaign against privacy.

Suggestions that they were actively using offshore structures to help clients cheat on their taxes were dismissed by Credit Suisse and HSBC on Tuesday, two of the world's largest wealth managers.

According to ICIJ, both the banks are involved in the setting up of complex structures that make it hard for tax collectors and investigators to track the flow of money from one place to another.

His bank was only after lawful assets, said Credit Suisse CEO Tidjane Thiam. The bank is now aggressively targeting Asia's wealthiest for growth.

The bank uses offshore financial structures, but only for very wealthy customers with assets in multiple jurisdictions acknowledged Tidjane Thiam while speaking at a media briefing in Hong Kong. However Thiam categorically mentioned that the practice is not intended to support the use for tax avoidance or allow the rich without knowing the identities of all those concerned.

"We do not condone structures for tax avoidance. Whenever there is a structure with a third party beneficiary we insist to know the identity of that beneficiary," he said.

The documents pre-dated a thorough reform of its business model, HSBC said separately.

Large fines over their wealth management or banking operations have been paid by both the banks in recent years to US authorities.

A $2.5 billion fine was agreed to be paid by Credit Suisse in 2014 for helping rich Americans evade taxes. $1.92 billion in fines for mainly for allowing itself to be used to launder Mexican drug money was greed to be paid by HSBC in 2012.

While China's government has yet to respond publicly to the allegations, the reports on leaks have pointed to the offshore companies that are linked to the families of Chinese President Xi Jinping and other powerful current and former Chinese leaders.

Many of the links that result from searches for the word "Panama" on Chinese search engines have been disabled or only open onto stories about allegations directed at sports stars.

Western media backed by Washington used such leaks to attack political targets in non-Western countries while minimizing coverage of Western leaders, indicated an editorial published in The Global Times, an influential tabloid published by the ruling Communist Party's official People's Daily.

(Adapted from Reuters.com)

The financial arrangements of high profile politicians and public figures as well as the companies and financial institutions they used for such activities are under the spot light due to the "Panama Papers" leak. The relatives of the leaders of China, Britain, Iceland and Pakistan, and the president of Ukraine and the friends of Russian President Vladimir Putin are among those who have been named in the documents.

There was response of denials from the leading figures and financial institutions to the massive leak of more than 11.5 million documents. As prosecutors and regulators began a review of the reports from the investigation by the U.S.-based International Consortium of Investigative Journalists (ICIJ) and other media organizations, those named in the leaks denied involvement in any wrongdoing.

With the Chinese state media denouncing Western reporting on the leak as biased against non-Western leaders, China has moved to limit local access to coverage of the matter following the reports.

While some countries, including the United States, said they were looking into the matter, other countries like France, Australia, New Zealand, Austria, Sweden and the Netherlands are among nations that have commenced investigations.

More than 240,000 offshore companies were set up for clients by Mossack Fonseca, the Panamanian law firm at the center of the leaks, even as the company has denied any wrongdoing. It claims that media reports misrepresent the nature of its business and calls itself the victim of a campaign against privacy.

Suggestions that they were actively using offshore structures to help clients cheat on their taxes were dismissed by Credit Suisse and HSBC on Tuesday, two of the world's largest wealth managers.

According to ICIJ, both the banks are involved in the setting up of complex structures that make it hard for tax collectors and investigators to track the flow of money from one place to another.

His bank was only after lawful assets, said Credit Suisse CEO Tidjane Thiam. The bank is now aggressively targeting Asia's wealthiest for growth.

The bank uses offshore financial structures, but only for very wealthy customers with assets in multiple jurisdictions acknowledged Tidjane Thiam while speaking at a media briefing in Hong Kong. However Thiam categorically mentioned that the practice is not intended to support the use for tax avoidance or allow the rich without knowing the identities of all those concerned.

"We do not condone structures for tax avoidance. Whenever there is a structure with a third party beneficiary we insist to know the identity of that beneficiary," he said.

The documents pre-dated a thorough reform of its business model, HSBC said separately.

Large fines over their wealth management or banking operations have been paid by both the banks in recent years to US authorities.

A $2.5 billion fine was agreed to be paid by Credit Suisse in 2014 for helping rich Americans evade taxes. $1.92 billion in fines for mainly for allowing itself to be used to launder Mexican drug money was greed to be paid by HSBC in 2012.

While China's government has yet to respond publicly to the allegations, the reports on leaks have pointed to the offshore companies that are linked to the families of Chinese President Xi Jinping and other powerful current and former Chinese leaders.

Many of the links that result from searches for the word "Panama" on Chinese search engines have been disabled or only open onto stories about allegations directed at sports stars.

Western media backed by Washington used such leaks to attack political targets in non-Western countries while minimizing coverage of Western leaders, indicated an editorial published in The Global Times, an influential tabloid published by the ruling Communist Party's official People's Daily.

(Adapted from Reuters.com)